Due Date to file 2022 W-2/1099 Forms for the State of Hawaii

File Your Tax Returns Before the Due Date & Avoid Penalties.

Start E-filing NowThe filing of W-2 & 1099 Forms is due by

28th February 2023

If the due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

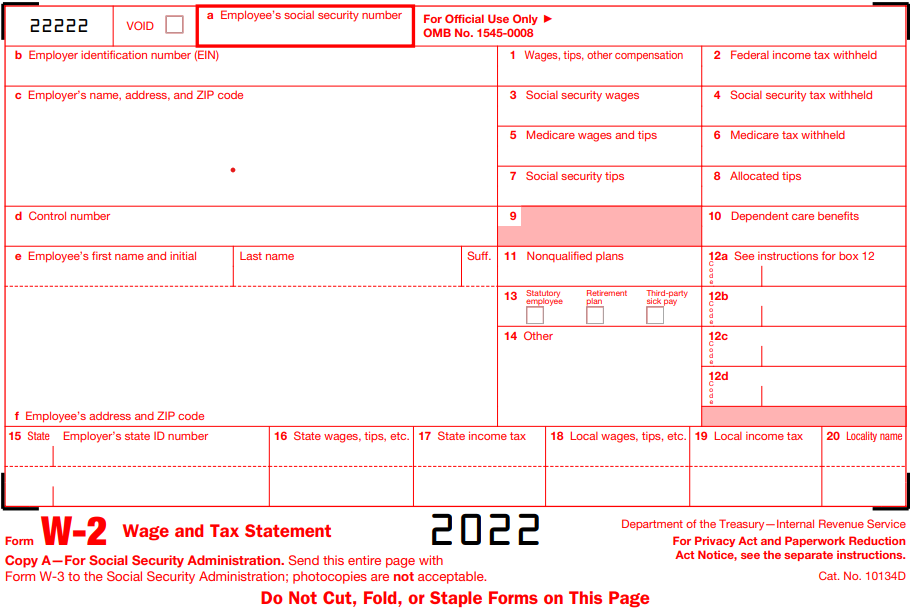

Form W-2

Form W-2 must be filed with the State of Hawaii by the employer directly even if there is no state withholding. Form W-2 is filed for each employee, which includes the gross wages, taxes withheld (Social security, Medicare).

The state of Hawaii instructs every employer to file the Reconciliation Form HW-3 along with the W-2 Form. Form HW-3 (an annual return) is a reconciliation Form which summarizes the total wages paid and the actual taxes withheld from the employees during the year.

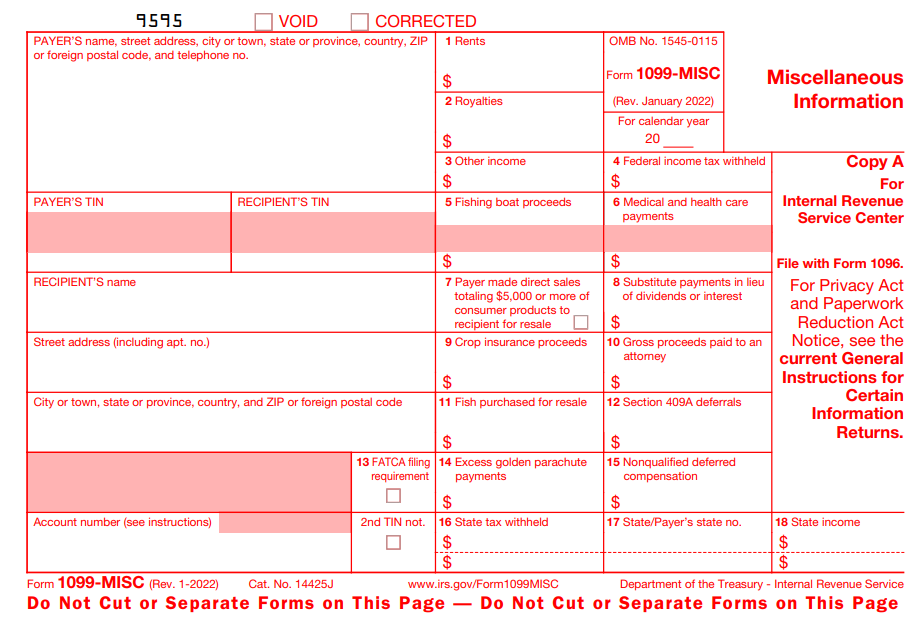

Learn MoreForm 1099

Form 1099, is the series of information return used to report the payment made to independent contractors, interest income, dividends and distributions, and even more.

The following 1099 Forms are required to be filed only if there is state tax withholding

| Form 1099-NEC | Form 1099-MISC | Form 1099-INT |

| Form 1099-DIV | Form 1099-R | Form 1099-B |

| Form 1099-G | Form 1099-K | Form 1099-PATR |

Information required to File

W-2/1099 with the State of Hawaii

The Following details are required to

file Form W-2/1099:

- Employer/Payer Details: Name, EIN/SSN, Employer Type, and Address.

- Employee/Recipient Details: Name, EIN/SSN, Address, and Contact Information.

- Federal & State Filing Details: Federal and State Income and Taxes Withheld.

Bulk Upload

To import information of employers/payers, employees/recipients all at once to e-file instantly.

Postal Mailing

We will take care of printing & mailing of your W2/1099 copies to employees/recipients.

Print Center

You can access the submitted returns from anywhere and at anytime.

Note that you can also e-file the other required federal Forms 941/940/944, 1095-B/C along with our software.

Click here to know about all our features & other supported Forms.

How to E-file W2/1099 Forms with the State of Hawaii

Below are the simple steps to e-file your W-2/1099 Forms:

- Create your free account.

- Choose W-2/1099 Form.

- Enter Employer/Payer, Employee/Recipient information

- Enter Form details such as Wages, & Taxes withheld from the employees/1099 Payments and taxes withheld from recipients

- Review, pay, and transmit the Forms.

It’s now simple and reliable of filing W2/1099 Forms with our Software

Where to mail Hawaii state filing Form 1099/W2?

Hawaii Department of Taxation,

P.O. Box 3827,

Honolulu, HI 96812-3827.